By Ashish Tyagi, Senior Equity Strategist, Divitas Capital

Equities though perceived by the masses as the riskiest instrument has its own good attached to its intangible risk. As rightly said by Socrates “Diversification is the key to wealth creation”, and one cannot imagine a diversified portfolio without an equity instrument; equities do play a major role in wealth creation.

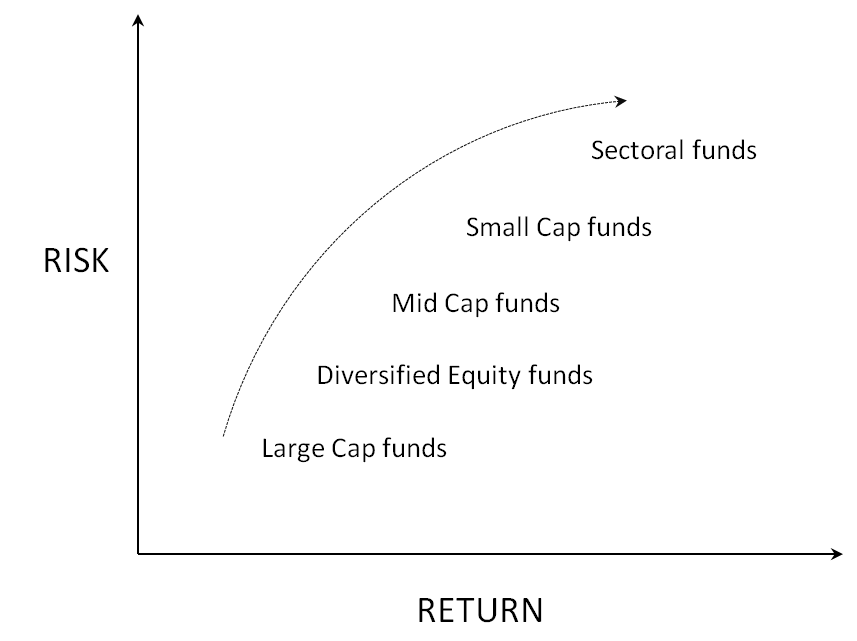

In any portfolio, debt is the tool of balancing the risk and volatility whereas equity finds its role in enhancing the return. Though equities come in hand with a relatively higher risk, the incentives do come in hand. As volatility is inherent to equity markets, the risk management approach minimizes the volatility. One should invest regularly and diversify across securities and mutual funds with a long term horizon for investments.

With time on your side, equities inevitably translate into higher gains over long term periods. When invested in a right manner coupled with the power of compounding, equities can result in stellar returns. Several studies have shown that equities, when held over a long term period, aren’t that risky, it’s only on the horizon of 1-3 years that equities show a wide variance and showcases a gloomy future ahead to the investor. The basis of growth of an equity instrument is highly dependent upon the growth of the market index of a country. India has been one of the fastest growing economies of the world showcasing a stellar growth rate of 7%, a similar trend is replicated in case of Nifty which is the index of National Stock Exchange showcasing growth rates much higher than the bank’s fixed deposit rates.

In equities, the risks over a long term period are not that high as perceived by the majority of people. In case of several listed equity shares, the annual growth rates have been exponentially higher than the index growth rate; such equities have proven to be the excellent medium of wealth creation for their shareholders. Apart from an appreciably high growth rate, there are several other advantages which equities offer such as entitlement to dividends, bonus, rights issue and liquidity benefit. Additionally, long term capital gains on any equity instrument are tax-free.

Despite the huge potential for long term wealth creation, most people end up losing money in stocks as they invest their money based on information or tips received from friends and relatives. Lured by the short-term gains, they keep speculating as to what will happen next and they pick wrong stocks that lead to large losses and eventually they start avoiding markets. Thus, the role of an Independent Financial Advisor becomes important. A good advisor helps you develop realistic expectations about the risks and rewards of each investment by avoiding the common pitfalls that are the cause of losses for most investors who invest on their own.

Like all the good things in life, even wealth creation takes its own sweet time. The sooner you begin, the better.

Recent Comments