Earlier we posted the SEBI survey finding on the investing habits in India. I decided to conduct a similar study within my group of friends. They are successful professionals - senior engineers, executives and mid-level managers at reputed companies, yet they had little idea about their personal finance. Most of them had investments only in Fixed Deposits and PPFs. This trend was very similar to the one in SEBI survey. From my conversations, I found that there were 3 main reasons for such trend –

Habits passed down from parents/family

Parents play an important role in our personal finances - most of my friends claim to have invested in FD accounts because their parents suggested doing so; the remaining ones conceded that FD investment seemed like a natural choice as in the case of their parents. What worked during the times of our parents does not necessarily function in the same manner today. Financial markets are highly developed and liquid now, and regulations are much tighter for the sake of investor protection.

Our propensity to risk aversion

Engaging in a risky activity goes against the standard societal practice. None of us want to end up as the only fool in the bunch. We tend to relegate everything other than FDs and PPFs as risky while failing to understand that FDs and PPFs generate investor returns in a similar mechanism as mutual funds do, albeit the returns can differ significantly.

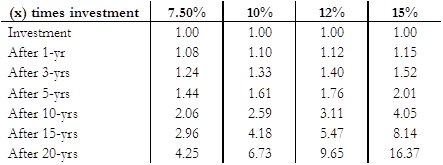

Over longer time horizon, mutual funds comfortably and consistently beat FD and PPF investment. The implication of this is huge – as illustrated in the table below, your lump sum investment of 1 unit in FD would yield 4.2x after 20 years, compare that to 9.6x return in case of mutual fund with 12% CAGR. You may ask - 12% year-on-year growth for 20 years, do such funds even exist? As a matter of fact, oldest running blue chip mutual funds have generated more than 15% CAGR over the period of 15 years.

Table: Compounding returns at different rates and investment horizon

Table: Compounding returns at different rates and investment horizon

Our modern lifestyle

All of us complain about being too busy on the weekdays, naturally we reserve our weekends for less stressful activities. Planning personal finance is no doubt an intensive process; however every weekend gone is an opportunity missed.

Contact an expert on personal finance, educate yourself on various investment options and start investing early to exploit the phenomenon of compounding returns. Although many alternatives are available, SIP investments in mutual funds work the best for retail investors. Amongst many reasons, the most important is that your money is being managed by professional investors who work 24x7 while you can enjoy worry-free weekends.

To sum up, we work very hard for money, now it’s time for our money to work hard.